Administered by

Select Plan (Level Funded)

The Select Plan is a level funded solution administered by Aetna. Level funding allows firms to enjoy the benefits of self-funding while reducing risk. Firms pay a preset amount that overs employee claims, plan administration, and stop-loss coverage.

Firms enrolled in a Level Funded plan administered by Meritain can access plan information here: Select Meritain Plans

Potential Surplus Return

At the end of the policy period, if your firm had lower costs than expected, your firm will receive 50% of the remaining funds back*. If costs are higher than expected, you’re covered by the Trust.

Provider Network

Members access the Aetna Choice POS II preferred provider organization (PPO) national network with pharmacy benefits managed by CVS Caremark.

*Firm must renew with the Trust to receive an experience refund. Subject to additional terms and conditions.

Plan Options

The Select Plan has over 90 plan options. For a detailed listing of plans, please click the following links: Standard Plans and Premier Plans. Plans offered include deductibles as low as $250 up to $8,000. The Trust offers over 40 HSA compliant plans. Contact us to discuss your specific needs.

Rx Formulary

The Trust offers broad access to a nationwide network of pharmacies and a wide selection of brand name and generic drugs. Click Here for the CVS Caremark Pharmacy Formulary

Plan Availability

*The Select Plan is available in the blue states (above) subject to regulatory requirements. States with eligibility restrictions (noted in orange) are: Rhode Island (10 - 100 employees), New Hampshire (100+ employees), New York (100+ employees), Maine (11+ employees), Wyoming (2-100 employees), Delaware (5+ employees), Kentucky (5+ employees), Alaska (51+ employees), Arkansas (51+ employees), Oregon (51+ employees). Contact us at [email protected] to confirm eligibility.

Select Plan Features & Benefits

Underwritten plans that consider characteristics of each firm

Firms receive an accounting of costs and claims paid during the policy period

Increased visibility of trends and utilization through TPA tools and services

Dedicated service teams through Aetna and the ACEC Life/Health Trust

Virtual Care

Members on the Select Plan have access to the telehealth services of CVS Virtual Care. CVS Health is an industry leader in 24/7 virtual care services and offers primary care and behavioral health care.

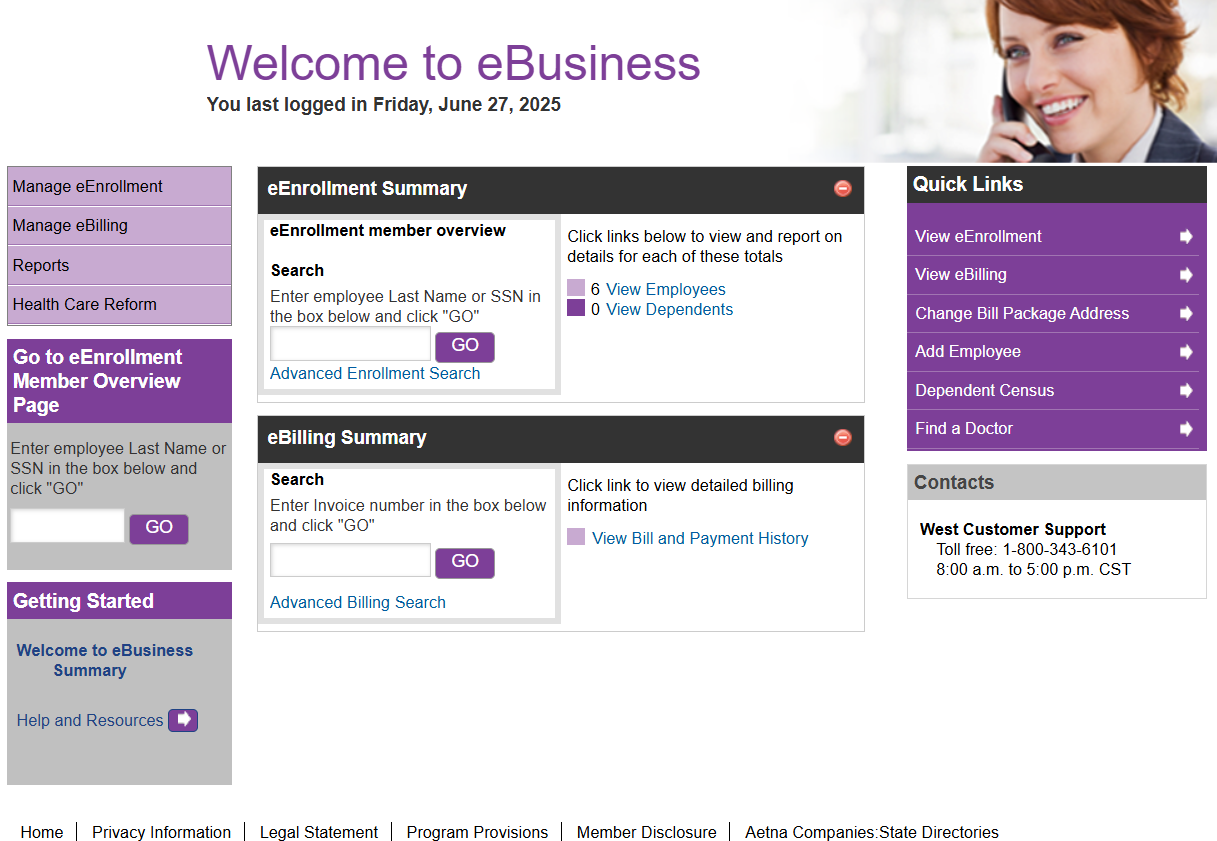

Online Services & Features

From the portal, employers can monitor utilization through a suite of financial and utilization reports. Employers gain access to the Aetna portal to manage enrollment, eligibility and billing. The Trust also has a dedicated microsite with additional information and materials: Aetna Engagement Portal